Early Saturday, Dec. 2, the U.S. Senate took a midnight vote on the new tax bill. It was passed on a 51-49 vote. All Democrats and only one Republican voted no. The new bill is a rewritten version of an earlier bill passed by the Senate panel and was only given to the Senate hours before the vote. The bill eliminates a lot of tax deductions.

The entire bill is 479 pages and is the largest overhaul of the U.S. tax code since 1986. Here’s a breakdown of the major clauses in the bill:

• There will no longer be a penalty for not having health insurance created by the Affordable Care Act. According to the Congressional Budget Office this will result in an additional 13 million people without health care coverage by 2027.

• Deductions on medical expenses have changed with the new bill. Currently, if someone’s annual medical expenses are above 10 percent of their qualified income, the amount above that threshold may be deducted. The new bill has lowered that percentage to 7.5 of a taxpayer’s annual income.

• Taxpayers are also no longer allowed to deduct state and local income or sales taxes, but can still deduct up to $10,000 in state property taxes. This could lead to wealthier taxpayers, who previously invested in public colleges, cutting that spending since they no longer receive a tax break.

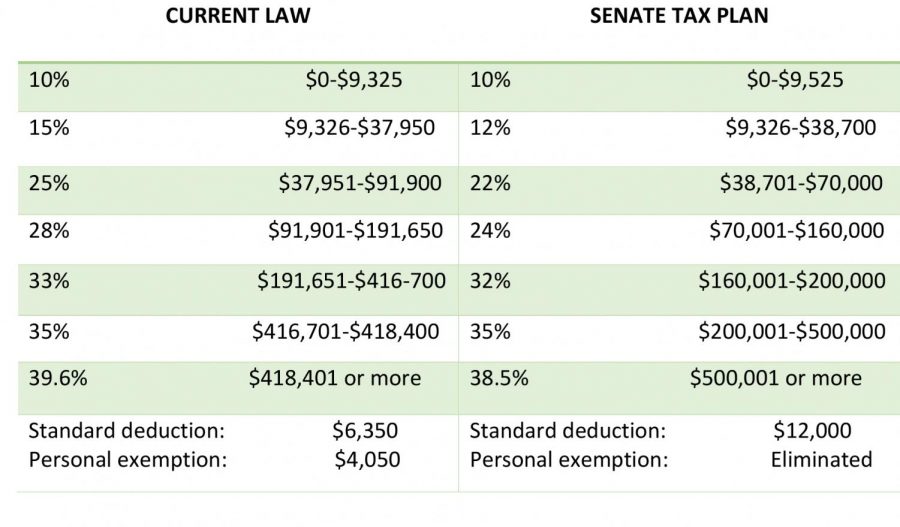

• The standard deduction is doubled from $6,350 for a single person and $12,700 for a married couple to $12,000/$24,000.

• Deductions for personal exemptions are repealed, but the child tax credit is doubled from $1,000 to $2,000.

• As for colleges and universities, both the Senate and House bills would create potential new tax burdens for higher education institutions and could, as college leaders predict, adversely affect charitable giving and state budgets that support public colleges and universities.

• The Senate’s tax bill does not include the House’s provisions to strip many tax benefits for students pursuing a college or graduate degree or paying off their loans, making it a significant improvement over the House’s tax bill. The House’s bill would also tax graduate student tuition waivers as income, a change that some say would make graduate education unattainable for many students

What’s next? Senator Paul Ryan will appoint negotiators on Monday, Dec. 4, to a committee that will work to meld the bill with the one the U.S. House of Representatives passed Nov. 16. The final tax bill is expected to land on the president’s desk for signature by the end of the year.